The Importance of Equitable Distribution in Divorce: Tips from a Brooksville Family Law Attorney

If you’re facing divorce in Florida, you’ll have to navigate equitable distribution laws that spell out how assets and debts get split between you and your spouse.

Many people assume it’s always a 50/50 split, but the truth is, Florida’s system is a bit more complex than that.

Equitable distribution just means the court divides assets fairly, looking at a bunch of factors, and sometimes “fair” isn’t the same as “equal.”

The process of ending a marriage under Florida law involves several steps. It can feel overwhelming if you don’t have someone to guide you through it.

You’ll need to figure out which assets count as marital property. Then, there’s the challenge of valuing assets like investments and businesses—each choice can significantly impact the outcome.

Florida divorce law actually gives couples more control than you might think. You can try mediation or work out a settlement, so you’re not just leaving it all up to a judge.

If you prepare and know what the courts look for, you’ll have a much better shot at a fair outcome that protects your finances down the road.

Key Takeaways

- Florida divides marital assets fairly, not always equally, and considers factors such as the length of the marriage and each spouse’s contributions.

- How you classify and value assets can significantly impact your outcome.

- You can avoid ugly court fights by negotiating or mediating, as long as you stick to state guidelines.

What “Equitable Distribution” Means in Florida (Not Automatic 50/50)

Florida courts consider marital property and strive for fairness, rather than simply dividing everything down the middle.

First, the court determines what constitutes marital property before deciding how to divide it.

Equal vs. Equitable: When and Why the Split Changes

Equitable distribution in Florida means the court attempts to divide assets and debts in a manner that is fair and reasonable for your specific situation. It’s not like community property states, where everything’s just cut in half.

Some of the big factors courts weigh:

- How long you been married

- Your financial situation

- Both financial and non-financial contributions to the marriage

- If someone put their career on hold for the family

- Whether it makes sense for one person to keep certain assets, like the house

If you stayed home to raise the kids, the court might give you a bit more than half. That’s the law’s way of recognizing sacrifices and lost earning power.

On the other hand, if someone blew through money recklessly or committed domestic violence, the judge could award them less. Florida courts try to land on what’s fair for your specific marriage, not just what looks even on paper.

Typically, judges begin with the assumption of an even split. However, they’ll tweak it if the facts require something different.

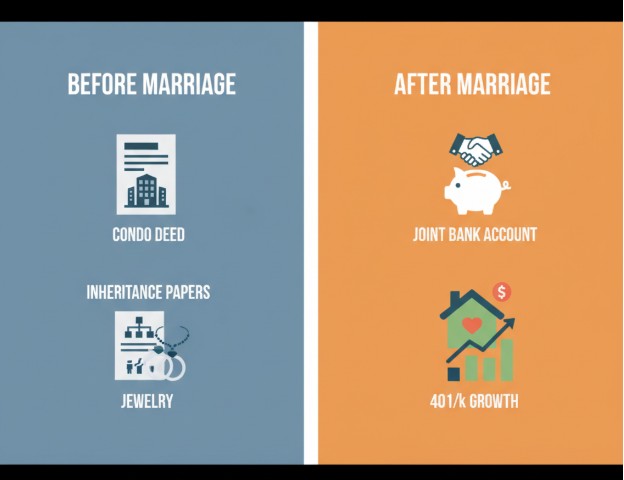

Marital vs. Nonmarital Basics: What Gets Set Aside Before Division

Florida draws a line between marital and nonmarital property. Only marital assets are divided in a divorce.

What counts as marital property?

- Anything you picked up during the marriage

- Money either of you earned after tying the knot

- Growth in value of separate assets, if that growth came from marital effort

- Retirement benefits built up during the marriage

Nonmarital property stays with whoever owned it:

- Stuff you owned before you got married

- Inheritances meant for just one person

- Gifts given to only one spouse

- Assets kept separate by a valid prenup

Courts sort this out before dividing anything. For example, if you bought a house before getting married, it usually remains yours alone.

But if your spouse chipped in on the mortgage or helped fix it up, part of that house might become marital property. That’s where things get messy and you’ll need to figure out what’s what.

Judges examine the source of the money and the actions taken. Bank statements and receipts can make or break your case if there’s a dispute over what’s marital or not.

The Florida Property Division Process— Steps You Can Follow

When you’re splitting up property in Florida, timing and paperwork matter a lot. Judges use specific dates to decide what’s in the pot, and whoever brings the best evidence usually wins the argument.

Cutoff & Valuation Dates: Why Dates Drive What’s “In” and What It’s Worth

Filing Date vs. Final Judgment Date

Florida courts pay close attention to two main dates. The filing date determines what constitutes marital property.

The valuation date is when they determine the value of everything. Most of the time, they use the date of the final judgment, but sometimes they’ll use the filing or separation date instead.

How Asset Values Shift

Assets such as stocks, retirement accounts, and businesses can fluctuate significantly between the start and end of a divorce. A business is worth $500,000 when you file, but only $300,000 when the judge signs off because the market tanked.

Real estate can also fluctuate in value, jumping or dropping. The date the court selects for valuing assets can significantly impact what each person receives.

Thinking Strategically

It’s smart to keep track of the value of your assets at several key points during the process. That gives you options and helps protect you if the market moves against you.

If your property goes up in value, you might want the later date. If it drops, you’ll probably push for the earlier one.

Evidence & Findings: How Judges Justify Outcomes (and Why Records Win)

What the Court Needs to See

Florida judges have to explain their equitable distribution decisions in writing. They cannot simply divide everything down the middle without considering the law.

You’ll want to gather financial records, appraisals, and maybe even expert opinions. If you don’t have the paperwork, your case can become shaky quickly.

Key Evidence Types

| Evidence Type | Purpose | Examples |

| Financial Records | Show what you own and what it’s worth | Bank statements, tax returns, investment account summaries |

| Appraisals | Pin down the fair market value | Real estate, businesses, and personal property |

| Contribution Evidence | Highlight non-financial input | Receipts for home improvements, records of childcare |

How Judges Use All This

Courts sift through the evidence to see what each spouse brought to the table. Non-monetary aspects, such as raising kids or keeping the house running, count just as much as bringing in a paycheck.

Judges also look for wasteful spending or attempts to hide assets. If you keep good records, you’ll have a much easier time getting your fair share.

Start your divorce journey with confidence—Mulligan & Associates makes equitable distribution in Florida clear and manageable. Discover practical solutions tailored to your specific needs—contact us today to schedule a consultation.

Classifying Assets: Gray Areas That Change the Outcome

Classification errors cause most disputes. Inheritances and premarital assets are often nonmarital—but commingling, mortgage pay-downs during marriage, and passive vs. active appreciation can convert portions into marital property.

Spell out sources, titles, and flows before you argue value or percentages.

Inheritance & Commingling: When “Nonmarital” Becomes Partly Marital

If you get an inheritance while married, it’s usually nonmarital property. But once you mix it with marital funds, the protection can vanish.

Some common ways inheritances get commingled:

- Putting inheritance money into a joint account

- Using it to cover household bills or pay the mortgage

- Adding your spouse’s name to the deed

- Investing inherited money in something you both own

If you mix everything together, you’ll have to prove what’s still yours alone. That usually means digging up detailed financial records and showing exactly where the money went.

Courts can use a few different methods to sort out commingled inheritances:

| Method | Description |

| Source of funds tracing | Follow the money to see where it ended up |

| Enhanced value approach | Splits up the original inheritance and any marital contributions |

| Transmutation | If you mixed it enough, the whole thing can become marital property |

How much you mix matters. If you only commingle a small amount, you may retain most of your inheritance. But if you throw it all in with the marital pot, you could lose it to equitable distribution.

Homes Bought Before Marriage: Equity Buckets

If you owned your home before getting married, things get split into three “buckets” during divorce. Each part gets treated differently under Florida law.

Premarital equity is the value of the home (minus the mortgage) on your wedding day. That part usually stays with you.

Marital pay-down equity is generated by using marital funds to pay down the mortgage. Both spouses have a claim here, no matter whose name is on the deed or who wrote the checks.

Appreciation equity is any increase in the home’s value during the marriage. The court determines whether the value increased due to market fluctuations (passive) or because you invested time and effort into it (active).

Here’s the difference:

- Passive appreciation (i.e., the market going up) typically remains nonmarital.

- Active appreciation (from renovations or improvements) becomes marital property.

Most of the time, it’s a mix of both. Courts try to figure out what percentage came from each and split accordingly.

Appraisals help pin down the values at marriage and divorce. If you don’t keep records of mortgage payments and improvements, you could lose out on your share.

Valuing Complex Assets (Business, Goodwill, Retirement & More)

Some assets aren’t so easy to value. Businesses, professional goodwill, and retirement accounts all need special handling in Florida divorces.

Courts look closely at what’s marital and what’s not, and splitting these up can get pretty technical.

If you’re dealing with this stuff, you’ll want experts and solid documentation on your side.

Business & Goodwill: Personal vs. Enterprise Value and Why It Matters

Business valuation in Florida divorce cases involves examining both tangible and intangible assets. Courts must determine the fair market value to ensure a fair division.

The real difference comes down to personal vs. enterprise goodwill. Only enterprise goodwill gets split in Florida. Personal goodwill? That’s off the table—it’s non-marital property.

Enterprise goodwill is value that sticks with the business no matter who owns it. Think about:

- Customer contracts and relationships

- Brand recognition and reputation

- Location perks

- Systems and processes

Personal goodwill lives and dies with the individual owner’s skills or reputation. For example, a doctor’s patient relationships, or a lawyer’s personal name in the community.

Florida’s statutory amendments following the Rosenberg decision clarified these definitions.

This difference significantly impacts business valuations, as personal goodwill can be a substantial portion of value that remains with the owner.

Professional appraisers try out different methods to separate these values.

They examine factors such as customer retention, the source of referrals, and whether relationships would endure if the owner were to change.

Retirement & QDROs: What Portion Is Marital and How Division Is Executed

Retirement accounts can get complicated. You have to determine what constitutes marital property and what does not. Only the money contributed and growth during the marriage counts as marital assets.

Marital portion calculation means looking at:

- Date of marriage to filing date

- Contributions made during marriage

- Growth tied to marital contributions

- Pre-marital balances are separate

Qualified Domestic Relations Orders (QDROs) actually facilitate the split. These court orders instruct retirement plan administrators on how to distribute benefits in accordance with the divorce decree.

Different retirement accounts have their own rules:

| Account Type | Division Method | Special Considerations |

| 401(k)/403(b) | QDRO required | Immediate distribution possible |

| Pension Plans | QDRO required | Future payments typically |

| IRAs | Transfer incident to divorce | No QDRO needed |

| Military/Government | Specialized orders | Unique federal rules apply |

The timing of division matters. Some plans allow the alternate payee to receive their share immediately, while others require you to wait until the participant actually retires.

Plan administrators have to approve the QDRO language before the court signs off. If they reject it, that can hold up the divorce and cause headaches down the road.

When Unequal Distribution Is Justified (Statutory Factors)

Classification errors cause most disputes. Inheritances and premarital assets are often nonmarital—but commingling, mortgage pay-downs during marriage, and passive vs. active appreciation can convert portions into marital property. Spell out sources, titles, and flows before you argue value or percentages.

Dissipation & Concealment: Proving Waste vs. Mere Disagreement

Courts seek a genuine distinction between simple disagreements and actual waste of marital assets.

Dissipation means one spouse purposely destroys or misuses property, thereby reducing the other spouse’s share.

Some classic dissipation examples:

- Gambling away retirement funds

- Moving money to secret accounts

- Blowing cash on affairs

- Trashing valuable property out of spite

Concealment is hiding assets from the court or your spouse. That could mean offshore accounts, secret business interests, or giving property to relatives.

Intent is everything. If you spend $50,000 on a luxury car during your marriage, that could be poor judgment. Spend it after filing for divorce to shrink the marital pot? That’s dissipation.

Courts require genuine evidence that the spending was intentional and intended to harm the other spouse. Factors for unequal distribution require documentation and testimony to support them.

Career/Earning Sacrifices: How Trade-Offs Show Up in the Numbers

If one spouse puts their career on hold or takes a hit to support the family (or the other spouse’s career), the court might give them a bigger share of the assets. These sacrifices can leave lasting financial scars that justify a little extra.

Common situations:

- Staying home with the kids

- Moving for the other spouse’s job

- Working part-time to handle the house

- Delaying school or job training

Courts consider both spouses’ current and future financial situations. If someone has less education or job skills, they might receive a larger compensation package to make up for it.

This often ties in with alimony. Someone receiving rehabilitative alimony for job training may receive less property, while a spouse who requires permanent alimony due to age or health may be entitled to more assets upfront.

Bridge-the-gap alimony helps with the short-term transition. Durational alimony covers a set period. Courts strive to balance support payments and asset division to ensure overall fairness.

How to Build Your Equitable Distribution Grid

Creating a clear grid helps keep track of all marital assets and debts. You’ll want columns for asset values, dates, and who owns what, as well as a way to even out any payment differences between spouses.

What to Include: Columns, Sources, Dates, and Subtotals

A solid equitable distribution grid needs certain columns. Basics are asset description, current value, acquisition date, and proposed distribution.

Required Columns:

- Asset/Debt Description

- Current Fair Market Value

- Date of Valuation

- Proposed Distribution (Husband/Wife)

- Asset Category (marital/non-marital)

Break assets into clear groups—real estate, vehicles, bank accounts, retirement accounts, and personal property. Each needs its own spot.

Valuation Sources: Professional appraisals are most effective for real estate and high-value personal items.

Bank statements show account values. Investment statements tell you about stocks and bonds.

Each asset needs a clear valuation date. Courts typically select the filing date or one close to the trial. Keeping the dates consistent helps keep things fair.

Subtotals show each spouse’s proposed share. The free equitable distribution worksheet can make all the math less painful.

Equalizing Payments: Lump-Sum vs. Structured, Interest, and Enforcement

When asset division leaves one spouse with more assets, the other may owe money. Courts have several options for handling this.

Lump-sum payments get it done fast—the paying spouse hands over the full amount at closing or soon after. This works best when someone has cash or liquid assets available.

Structured payments break it up over time. Monthly or yearly payments can be helpful if the payer cannot pay the entire sum at once. Courts might want some security, like a lien on property.

Interest is a significant concern for payments that are delayed. Florida’s laws let courts tack on interest to protect the spouse who’s waiting from losing value to inflation.

Enforcement options include:

- Liens on real estate

- Wage garnishment

- Asset seizure

- Contempt of court

The final judgment should clearly outline payment terms, including due dates, interest rates, and the consequences of non-payment. Otherwise, you’re just asking for trouble later.

When property division gets complicated, Mulligan & Associates streamlines equitable distribution cases with proven strategies. Protect your financial future by planning—reach out now to schedule a consultation.

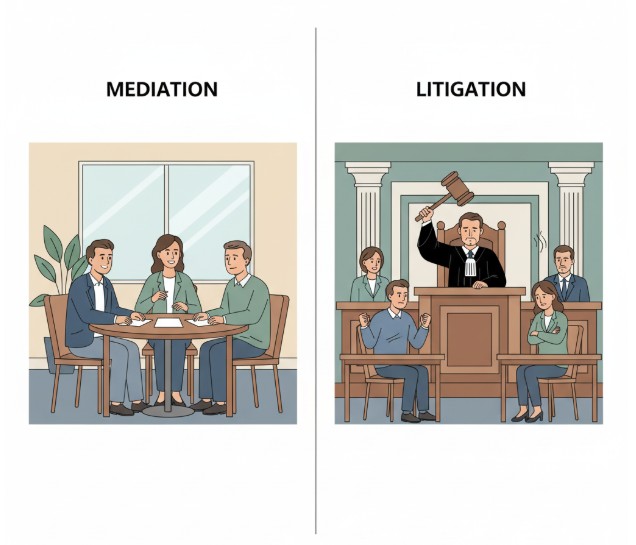

Avoiding Court: Mediation & Marital Settlement Agreements

Most couples resolve equitable distribution via mediation or a marital settlement agreement.

You maintain control over timing and terms, tailor tax/transfer details, and reduce fees—while ensuring the agreement aligns with Florida law, making it enforceable and smooth to finalize.

Mediation Game Plan: What to Prepare and How to Negotiate

Good mediation starts with good prep. Bring every financial document you can get—bank statements, retirement balances, property deeds, the works.

Essential Documents for Mediation:

- Tax returns (last three years)

- Mortgage statements and property appraisals

- Investment and retirement account statements

- Credit card and loan balances

- Business financial records if you’ve got a business

The mediation process has perks over going to court. It’s usually cheaper and gives you more say in the outcome.

Before mediation, make a wish list. Know what matters most and where you can give a little.

Effective Negotiation Strategies:

- Focus on interests, not just positions

- Think about taxes—some assets come with hidden costs

- Plan for the future, not just today

- Stay flexible on stuff you care less about

The mediator guides the conversation, but can’t force anyone to agree. Couples must work out their own arrangements for all marital assets and debts.

Drafting the MSA: Clarity on Titles, Transfers, Timelines, and Taxes

The marital settlement agreement (MSA) becomes legally binding once both sides sign. It’s worth getting every detail right so nobody gets burned later.

Critical MSA Components:

| Element | What to Include |

| Property Transfers | Exact deadlines for deed transfers and account changes |

| Debt Responsibility | Who pays which debts, and by when |

| Retirement Assets | QDRO requirements and account split details |

| Tax Issues | Who claims deductions, who pays tax bills |

The agreement should include clear timelines for all aspects. For example, transfer the house deed within 30 days of the divorce decree—don’t leave it vague.

Retirement splits need special court orders (QDROs). Spell out exactly who gets what percentage of each account in the MSA.

Taxes can significantly impact the value of assets. The agreement should specify who pays capital gains and who is entitled to claim mortgage interest.

Vague language just leads to fights later. Instead of “husband gets the business,” write out the transfer process and any ongoing obligations in detail.

Equitable vs. Community Property—Quick Comparison Table

Florida uses equitable distribution principles, not community property laws. If you’re divorcing, knowing the difference matters more than you’d think.

The table below lays out how these two systems actually work:

| Aspect | Equitable Distribution (Florida) | Community Property |

| Division Method | Fair but not always equal | 50/50 split of marital property |

| Court Factors | Multiple factors considered | Limited factors considered |

| Flexibility | High judges have discretion | Low – strict equal division |

| Property Types | Only marital property is divided | All community property is divided |

| States Using System | 41 states, including Florida | 9 states (California, Texas, etc.) |

Key Differences

Equitable distribution states divide property equitably, not always equally. Judges actually look at a bunch of factors to decide what’s fair.

Community property states divide marital assets equally—50/50. Judges have barely any room to maneuver, regardless of the situation.

Florida’s approach gives the courts more flexibility. They can weigh each spouse’s needs and what they brought to the marriage when dividing assets.

Essential Divorce Document Checklist for Florida Equitable Distribution

Gathering complete documentation is the first step to ensuring a fair and accurate division of property in Florida.

Courts want a clear record of assets, debts, and income, and being organized reduces delays, costs, and disputes. Use this checklist as your roadmap.

Financial Records

| Document Type | Examples to Include |

| Bank Statements | Checking, savings, money market accounts |

| Investment Records | 401(k), IRA, stocks, bonds, mutual funds |

| Real Estate | Deeds, mortgage statements, appraisals |

| Insurance Policies | Life, disability, homeowners, auto |

| Debt Records | Credit cards, student loans, mortgages |

Employment & Income Proof

| Document Type | Examples to Include |

| Pay Stubs | Past 3 months |

| Tax Returns | Last 2 years |

| Self-Employment Records | Profit & loss statements, business tax returns |

Personal Property Documentation

| Document Type | Examples to Include |

| Vehicle Records | Titles, registration papers |

| High-Value Items | Appraisals for jewelry, art, and collectibles over $500 |

| Supporting Evidence | Photos, receipts for valuables |

Business Ownership & Interests

| Document Type | Examples to Include |

| Business Financials | Profit & loss statements, balance sheets |

| Tax Records | Business tax returns |

| Agreements | Partnership agreements, operating agreements, bylaws |

| Valuations | Professional appraisals when required |

Digital & Online Assets

| Document Type | Examples to Include |

| Cryptocurrency | Exchange statements, wallet records |

| Online Banking | Digital bank statements |

| Payment Apps | PayPal, Venmo, CashApp transaction records |

Pro Tip: Both spouses should complete the same worksheet. This ensures records are consistent, reduces surprises, and provides mediators or judges with a clear picture.

Mulligan & Associates helps Florida families resolve equitable distribution fairly, from valuing assets to negotiating settlements. Take the next step toward clarity and resolution—contact us now to schedule.

Frequently Asked Questions

Is Florida a 50/50 divorce state?

Florida starts with the presumption of a 50/50 split of marital assets and debts; however, the court may adjust this split based on statutory factors, including income, contributions, and the waste of assets.

What counts as marital property in Florida?

Marital property includes assets and debts acquired during the marriage—such as homes, bank accounts, retirement contributions, and loans—regardless of whose name is on the title.

Are inheritances divided in a Florida divorce?

No. Inheritances are generally considered nonmarital property in Florida, unless they were commingled with joint accounts or used for marital expenses, which can convert them into marital assets.

How are retirement accounts divided in a Florida divorce?

The marital portion of retirement accounts, pensions, or 401(k)s is subject to equitable distribution. Courts often use a Qualified Domestic Relations Order (QDRO) to split funds without tax penalties.

Can one spouse keep the house in a Florida divorce?

Yes. A spouse may keep the marital home if they can buy out the other’s share or if the court finds it equitable, often when children’s stability is a factor. Otherwise, the home may be sold.

What happens if a spouse hides assets in a Florida divorce?

If one spouse hides or wastes assets, the court may award the other spouse a larger share of the marital estate or impose sanctions to ensure fairness.

How do Florida courts value property during divorce?

Courts typically select a valuation date—often the filing date or mediation date—and rely on appraisals, statements, or expert reports to determine the fair market value for division.

Can mediation resolve equitable distribution in Florida?

Yes. Most equitable distribution cases are settled through mediation, where spouses negotiate asset division with a mediator’s help—avoiding trial, saving costs, and keeping more control over the outcome.